What are pro forma financial statements?

When it comes to making business decisions, so much relies on numbers. To get a sign-off from key stakeholders in your business and gain trust from your investors, you need to demonstrate that your ideas make financial sense.

While financial statements which include balance sheet, income statement, and cash flow statement help provide a historical snapshot of a business’s performance, sometimes these statements lack the ability to provide a future snapshot when planning for the future operations. For this reason, business owners rely on forecasts & financial projections (pro forma financial statements being one example) to guide their plans and answer critical “what if” questions.

A business may create pro forma reports to assess the profitability of a product or service or to determine if a business expansion makes financial sense.

For business owners, the term pro forma means “what if”. Pro Forma Financial Statements are a set of projected financial statements, including the balance sheet, income statement, and cash flow statement, based on a set of assumptions.

What is the purpose of Pro Forma Financial Statements?

A pro forma financial statement can be used in a variety of scenarios:

- Business Financing/Loan: A commercial lender would like to look at financial statements for prior years, and pro forma financial reports for future years. Pro forma earnings, for example, projected net income to determine the ability of the borrower to repay the loan on-time.

- Capital Investment: A company’s capital structure may include a combination of debt and equity. Existing and potential investors would like to see a pro forma income statement to assess a firm’s plan & ability to generate positive net income.

- Financial Planning: Pro forma statements are also used to analyze the financial impact of a major business decision. If you’re considering adding a product or a service line, opening a new location, or closing a company’s division, pro forma reports will help you project the outcome of your decision thus helping you make strategically sound decisions.

What are the benefits of Pro Forma Financial Statements?

- Pro forma financial statements help owners identify growth opportunities, and reduce risk wherever possible.

- Pro forma financial statements can be used to evaluate alternatives. Since every business has limited resources, use of this tool can help you make better decisions and mange your limited resources efficiently.

- Pro forma statements can also be used to generate financial ratios. If, for example, you want to calculate the impact on the debt to equity ratio in future years, you can use the data from pro forma reports and understand the positive/negative impact of your plans.

Limitations of Pro Forma Financial Statements

- Since these statements are based on assumptions, they shouldn’t be taken as fact. Rather, they should only be used to make informed decisions using hypothetical data based on historical trends.

At Profit & Loss Management, we help our clients with all types of business needs whether it is accounting, payroll, taxes, consulting, and/or forecasting in order to help them stay focused on growing their businesses.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

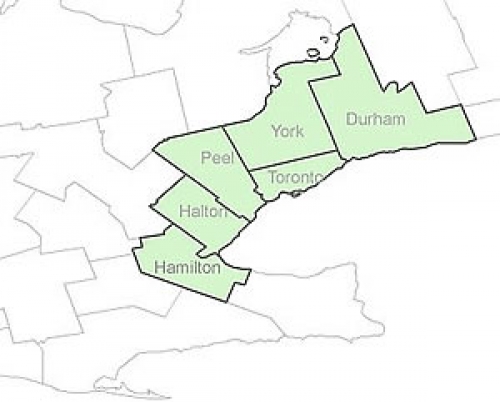

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill