We also provide monthly, quarterly and yearly HST filing for your business

If you are registered with Canada Revenue Agency for GST/HST then you would be required to file a periodic return in which you would be reporting taxable sales, and calculating the amount of GST/HST which must be remitted to the federal government for that period. Failing to file and pay GST/HST on-time, and accurately can lead to hefty penalties.

To some extent, you may have a choice in how often you are required to file your GST/HST return depending on your business size.

When the return period is annual, returns and remittances for the period are due generally no later than three months after the fiscal year-end of the business

Any GST/HST remittance owed for the year is due and payable to the federal government by April 30th.

At Profit & Loss Management, we help corporations, small businesses, SMEs, and self employed individuals stay compliant with their HST filings. If you have a business and require your HST return to be prepared and filed with CRA, you can contact us and we can prepare and file it for you so you can avoid any penalties and/or Interest charges due to late or no filing.

Besides HST compliance, we help our clients in maintaining their HST records to ensure easy filing at the end of their reporting period, whether it be monthly, quarterly, or annually. We help compile relevant documents and information, and prepare your HST return accurately.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

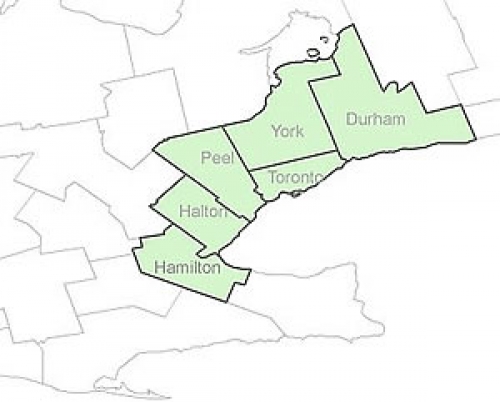

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill