Financial Analysis/Consulting

We will assist you in planning for all of your personal and business financial needs. This involves preparing cash flow projection statements to assess the financing needs, cost analysis, variance analysis, ratio analysis, sales forecast and budgeting.

Often businesses end up in bankruptcy due to lack of cash flow which can happen there are no processes in place to monitor working capital and cash flow. Being in control of your cash flow and working capital can help you avoid financial issues occurring and helps your bank and creditors feel more confident about the future of your business. Through our financial analysis and advisory services, we give you the expert advice you need so you feel completely in control of your finances while operating your business.

The goal of financial analysis & consulting for a business is to comprehensively analyze the past data and then prepare time-based plans for the future that include the probability of unforeseeable circumstances. Our financial analysis service will also identify how to accurately monitor progress and identify important benchmarks and relevant key performance indicators (KPIs). This will allow you as a business owner/manager to catch problems before they get out of control, make critical business decisions in a time fashion, and also adapt to ever-changing economic circumstances.

In order for your business to grow consistently, identifying, utilizing, and monitoring critical key performance indicators (KPIs) should always become a key aspect of your analysis. This is why we work with our clients and use a variety of tools to help them determine the right KPIs to use and monitor in their business.

Analyzing financial worth of a business?

At Profit & Loss Management, we perform purchase evaluations for our clients. When performing business valuations, we look at various methods & tools available to provide you the average price of the business you are interested in.

Identifying and evaluating financial risks such as credit risks, liquidity risks, and operational risks will also allow you as a decision maker to understand every aspect and risk associated with a potential business acquisition, and plan for the best scenario while preparing for the worst scenario as well.

To ensure you do not end up over paying when purchasing business, be sure to give us a call so we can provide with a evaluation of the business you are interested in acquiring.

At Profit & Loss Management, we help our clients with all types of business needs whether it is accounting, payroll, taxes, consulting, and/or forecasting in order to help them stay focused on growing their businesses.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

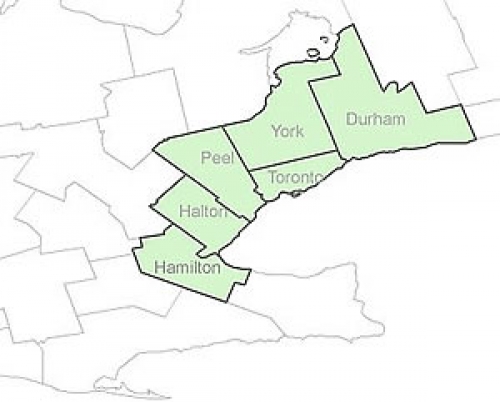

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill