Consult with Us on Taxes

As Tax consultants, we not only help our clients save on taxes (personal & corporate taxes), but we also give them important tips, strategies, and legal avenues through which they can save money on their taxes .but they can file your taxes for you as well. When you consult with us on taxes, we go through your unique tax situation, and identify your short-range, and long-range plans. This way we identify areas through which you will have tax saving opportunities available to you and we can help you avail such opportunities. We do this by designing a tax plan for you, ,your business and/or your dependents.

What is a Tax Plan?

A tax consultant with relevant knowledge and experience in the industry can design and recommend tax solutions to you by sitting with you and creating a tax plan based on your current situation, and future plans. A tax plan will bring actionable items creating a pathway that you will follow in order to ensure that you maximize every tax saving opportunity that may apply in your circumstances. As part of our tax plan we:

- Assist in choosing a tax-efficient business ownership, and operations structure

- Review and analyze your business & personal contracts, and agreements from a tax standpoint to identify potential opportunities available for tax planning

- Review opportunities for income splitting

- Review tax savings opportunities through investments in RRSPs, RESPs, and TFSAs.

- Exploring opportunities using Tax Loss Harvesting

Through many of the strategies and tools available to us, our tax advisors focus on reducing and/or defering the most amount of taxes payable through legal means in any given period of time.

At Profit & Loss Management, we help our clients with all types of business needs whether it is accounting, payroll, taxes, consulting, and/or forecasting in order to help them stay focused on growing their businesses.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

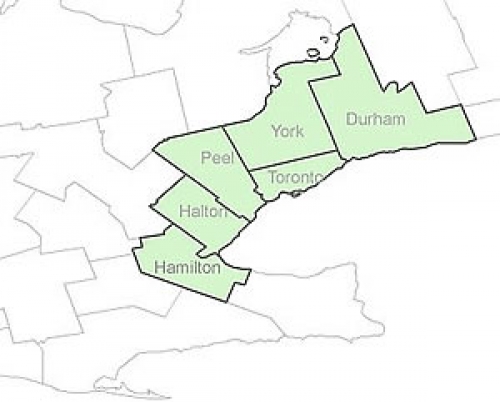

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill