Looking to register your payroll account with CRA?

To set up a payroll system for your business, a business owner/entrepreneur needs to register the business and then register a payroll account with the Canada Revenue Agency (CRA).

If you are a business paying salaries, wages, tips, gratuities, bonuses, then you are legally obligated to have a payroll program registered with CRA in Canada. At Profit & Loss Management, we help businesses through all stages of the payroll process, from the initial set up to issuing pay cheques to employees to tracking deductions, and remitting payroll taxes to the government.

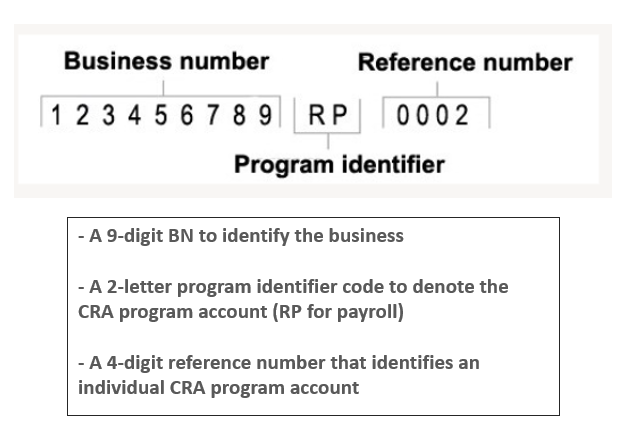

Our Team at Profit & Loss Management can complete your payroll account registration on your behalf and set up your payroll in compliance with the Government Of Canada requirements. Once we set up your payroll program, you will receive a 15-character account number that identifies your payroll program with the Canada Revenue Agency.

During the registration process, we will also work with you to set up the following besides your payroll program account with CRA:

- Upon eligibility, register with the Ontario Ministry of Finance for Employer Health Tax (EHT) Account.

- Upon eligibility, register with the Ontario Workplace Safety and Insurance Board (WSIB) for a WSIB Account.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

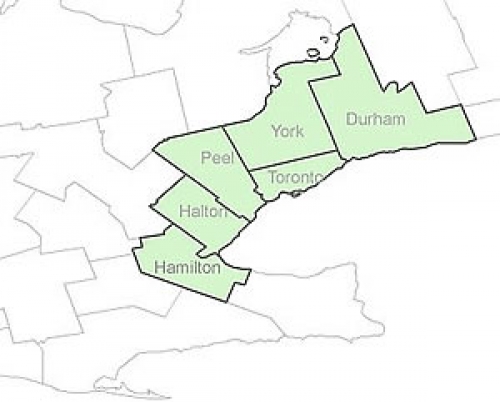

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill