What is a Corporate Tax Return & When do you need to file it?

According to Canada Revenue Agency (CRA), all resident corporations (except crown corporations and resident charities) are required to file a corporate income tax return (also called T2) every tax year even if there is no tax payable. Tax Year for a corporation is its fiscal period. Some corporations choose to have a calendar year and some choose a non-calendar year (e.g. April – March) when it comes to fiscal year.

In terms of filing and payment deadlines, filing deadline is six months after the year of the fiscal year. However, when it comes to the tax payable payment deadline it is 90 days after the end of the fiscal year. So if you estimate that you will end up with a tax payable then it will be important to keep in mind the 90 day deadline to avoid any interest and/or penalties on late tax payment.

What we offer through Corporate Tax Services

We work with our clients in order to minimize their tax liabilities. Our tax experts ensure that your tax returns are filed accurately, comply with all tax laws and regulations, and avail all relevant deductions available to your corporation. Even if your business is small and your corporate tax return may seem simple enough, our team will apply their expertise in finding, and applying deductions and/or tax credits that you may have missed. Through our corporate tax services we offer:

- Preparation & filing of your corporate income tax return (T2).

- Access to experienced and professional team to help you through the process of taxes

- Walk through of the tax process and help you facilitate all the paperwork required to file your taxes correctly & on time.

- Converting accounting financial statements to General Index of Financial Information (GIFI) to be used for filing your return.

- Calculating the optimal salary or dividends to draw from your corporation.

- Implementation of tax saving strategies to help you and your business save taxes

In terms of Corporate Tax Returns, they must be filed within 6 months following the fiscal year end. All payments for taxes owed must be paid within 90 days after year end. If you own or manage a corporation and need to file the corporate return then be sure to do so as failure to file the return and/or making payments on taxes owed could result in penalties and interest charges.

At Profit & Loss Management, we help our clients with all types of business needs whether it is accounting, payroll, taxes, consulting, and/or forecasting in order to help them stay focused on growing their businesses.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

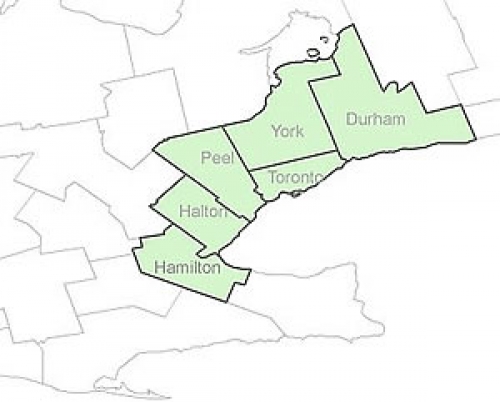

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill