Looking for Assistance with CRA matters? (Personal and/or Corporate)

Having appropriate documentation ready prior to submitting your taxes is a critical step which can help you stay prepared for potential CRA inquiries in relation to the activities of your business and/or your personal tax matters. Dealing with the tax authority can get stressful if you do not have experience, knowledge and most importantly documentation related to your tax submissions. Not providing adequate documentation and/or response could result in unexpected tax consequences whether it is related to your personal tax returns or your corporation’s tax returns. Someone might ask, is the risk worth it in the end?

Any time you receive a letter from the CRA (whether it’s for your corporation or your personal taxes) requesting documentation and/or indicating a reassessment, we can help you prepare an appropriate response and/or represent you depending on how you would like the situation to be managed.

At Profit & Loss Management, we can help you prepare responses, and appropriate documentation in relation to CRA questions/audits in a professional manner. We will use our technical knowledge and experience in taxes to help you achieve the best possible outcome in your tax situation.

Through our CRA audit services we focus on:

- Advising you on your options, and providing recommendation on the best option based on your situation

- Preparing adequate documentation and response

- Obtain best possible outcome for your situation

- Minimize taxes, and avoid/minimize interest and/or penalties (if any)

Looking to adjust your Tax Return(s) from prior years?

The Canada Revenue Agency (CRA), by law, allows adjustments to tax returns for a 10-year period. This means that if you’ve filed your return and then determined that you need to make a change, either because you have received another T-slip, or because you didn’t claim an expense and later realized that it was deductible, you can request an adjustment to your tax return. We can help you determine if the additional expense/income item is expected to make an impact on your prior tax returns, and whether you are required to adjust your prior tax returns or not.

At Profit & Loss Management, we help our clients with all types of business needs whether it is accounting, payroll, taxes, consulting, and/or forecasting in order to help them stay focused on growing their businesses.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

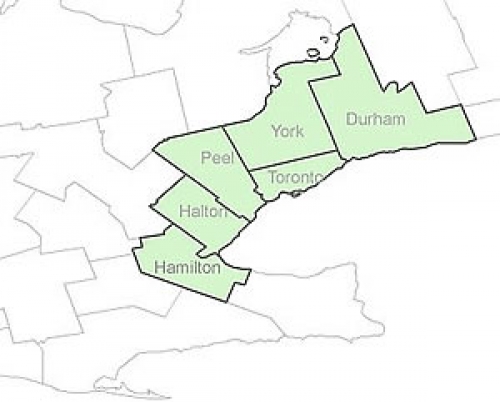

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill