Looking to Register for Employer Health Tax (EHT) and Filing?

To effectively navigate your business’s payroll tax obligations, businesses need strategic solutions from professionals with an understanding of all the relevant requirements, both federal and provincial.

Every Workforce across Canada is a crucial resource that drive the economy and allow businesses & industries to operate effectively. Keeping workers safe, healthy and protected is therefore an important part of any business’s success. Eligible Canadian corporations, charities and not-for-profits are required to make financial contributions to the health and well-being of their employees – in the form of workers’ compensation and/or the Employer Health Tax (EHT).

What is Employer Health Tax (EHT)?

The EHT is a payroll tax paid by Employers in Ontario based on their total annual payroll remuneration. EHT contributions made by an employer are determined by the rate attributed to their remuneration. However, employers are entitled to an exemption on the first $490,000 of remuneration.

The Ontario government has increased the EHT exemption for 2020 from $490,000 to $1 million due to the special circumstances caused by the coronavirus (COVID‑19) in Ontario. In the 2020 Ontario Budget, the government announced it was making the EHT payroll exemption increase permanent.

Do I have to pay EHT?

You have to pay Employer Health Tax if you are an employer and you:

- have employees who physically report for work at your permanent establishment in Ontario, or

- have employees who are attached to your permanent establishment in Ontario, or

- have employees who do not report to work at any of your permanent establishments but are paid from or through your Ontario permanent establishment, and

- have Ontario payroll in excess of your allowable exemption amount.

At Profit & Loss Management, our team can help you register for EHT with the Ministry, prepare your EHT Filings, and help you stay current with any strategies available to your business in order to minimize your EHT obligations.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

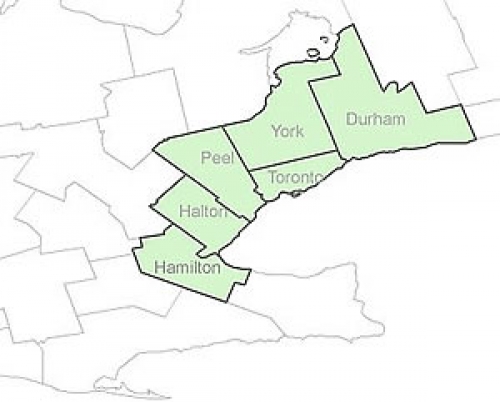

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill