Personal Tax Services

We provide personal tax services to individuals with all kinds of unique situations including:

- Individuals with employment income, sole proprietorship businesses, partnerships, unregistered businesses etc.

- Individuals with dependents, child care expenses, medical expenses, tuition expenses, disability, stock benefits etc.

- Individuals with investment income, rental income, home office expenses, corporate dividends/salary etc.

Since every individual’s tax situation is different, therefore, we use a variety of tools continue our discussions with our clients to understand their tax situation. Once we have enough details then we focus on utilizing any relevant tax credits/deductions available to optimize their situation while minimizing the tax liabilities. Our tax experts also ensure that tax returns for our clients are filed accurately and comply with all tax laws and regulations.

At Profit & Loss Management, we will determine appropriate deductions as well as credits that you may be eligible to ensure that your tax liability is minimized. We have listed below some of the deductions & credits that you may be eligible for:

Employment Expenses

Stock Options

Legal Expenses

Moving Expenses

Disability Amounts

Tuition Fees, and Educational Amounts

Interest paid on Student Loans

Membership Dues

Union & Professional Dues

Expenses Relating to a Rental Property

Spousal Amounts

Rent or Property Tax Credit

Dependents

Caregiver Amounts

Medical Expenses

Child Care Expenses

Child Fitness Credit (max. $500 per child)

Charitable Donations

Climate Action Incentive Credit

When is my personal tax return due?

The filing deadline for an employed individual is April 30th. If you owe any tax for the tax year then you will be required to pay any amounts owing by the April 30th deadline as well. If you have self-employed then your filing deadline to submit your personal income tax return is June 15th. However, your payment deadline for any taxes owing for the tax year is still April 30th.

In case you do not make full payment on any taxes due by April 30th then Interest at the prescribed rates will start to accrue. Besides the interest, CRA may impose penalties if taxes are not submitted within the required reporting period.

To ensure that all of the applicable deductions, and credits have been applied to your personal tax return accurately, be sure to have your taxes prepared and filed by professional accountants at Profit & Loss Management.

Our professional team are always ready to help our clients manage all aspects of their accounting function, from Bookkeeping, and Filing HST returns to preparing Financial Statements, and Corporate & Personal Tax Returns.

If you are looking to have one firm take care of accounting and tax needs then you have arrived at the right spot! We offer a special service which we call Outsourced Accountant through which we can take care of all the accounting, payroll, hst, consulting, personal tax, and corporate tax needs for you and your business! Curious if that is suitable for you? Click on the following link to find out more:

Looking to hire us?

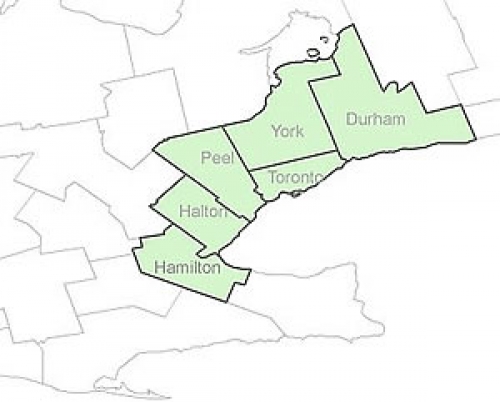

Areas We Serve

Toronto

Mississauga

Oakville

Vaughan

Hamilton

Burlington

Richmond Hill